| |

Table of Contents - What Is Pay Personal Property Taxes Online?

- Why Is My Email Address Needed?

- Where Can I Find the Department Number, Ticket Number and Amount?

- How Do I Pay Personal Property Taxes?

- Department Number & Ticket Number

- PIN

- Account Number

- Bill Detail

- Online Payment Checkout Screen

- Pay By Credit Card

- Do Additional Charges Apply for Paying Online?

|

|

| |

| Pay Personal Property Taxes Online enables online payments for personal property tax bills received from New Kent County. |

| Back to Top |

|

| |

| Your email address is a unique identifier used to combine tickets marked for payment into one lump sum. |

| Back to Top |

|

| |

| Please refer to your Tax Bill. The ticket number is shown on the bill. The department is typically PP + the year the tax ticket was issued. For example, PP2011 for 2011 taxes. |

|

| In this example: Department Number is RE2004 Ticket Number is 150 Amount is 12825.56 |

| Back to Top |

|

| |

| On the first screen, enter your email address and then press OK button. |

| |

|

| OK |

|

| On the Pay Personal Property Taxes Online Screen, press the button containing your preferred method for finding tax information: Department & Ticket Number, or PIN. |

| |

|

| Back to Top Pay Using Department & Ticket Number Pay Using PIN Pay Using Account Number |

|

| Pay Using Department Number & Ticket Number - Enter the Department Number and Ticket Number. Verify the numbers are correct, press the Search button and the Total Bill screen is displayed. |

| |

|

| Back to Top Proceed to Total Bill |

|

| Search By PIN - Enter your unique PIN and Last Name. If you need to create a PIN for access, click the link next to "To create a PIN or for other PIN option" above the buttons. You can enter a Projected Date to calculate Penalty and Interest. Otherwise, the field defaults to the current date for penalty calculations. Press Search button to find records. |

| |

|

| Back to Top Proceed to Total Bill |

|

| Search By Account Number - Enter your Account Number and Last Name. You can enter a Projected Date to calculate Penalty and Interest. Otherwise, the field defaults to the current date for penalty calculations. Press Search button to find records. |

| |

|

| Back to Top Proceed to Total Bill |

|

| Total Bill Screen - The full amount due is shown in the Enter Amount You Wish To Pay Today field, but a different amount can be paid by replacing the figure shown. To view bill details, click Details link next to the desired ticket. To search for another Personal Property ticket and attach it to the current bill before payment is made, press the Pay Another PP Bill button. To pay the current Personal Property bill only, or to add a bill using another Web application, press the Checkout button. If the information shown is incorrect, press the Return to Search button and return to the Pay Real Estate Taxes Online screen. |

| |

|

|

| Back to Top View Bill Detail Screen Checkout Pay another PP Bill Return to Search |

|

| Online Payment Checkout Screen - The Total Payments field displays the elected payment amount for the attached bills. All tickets can be removed by pressing the Clear Shopping Cart button. |

| |

|

| Back to Top |

|

| Bill Detail Screen - This screen contains additional information about the tax bill. Press Previous button to return to Total Bill screen. |

| |

|

| Back to Top Previous |

|

| Online Payment Checkout - The Total Payments field displays the elected payment amount for the attached bills. All tickets can be removed by pressing the Clear Shopping Cart button. |

| |

|

| Back to Top Pay by Credit Card |

|

| Pay By Credit Card - Payment Amount + Convenience Fee = Total Due. Press Proceed to Payment button to enter Credit Card information. |

|

|

|

| Input Credit Card and Billing Information and then press the I Authorize this transaction button. Pressing Reset button clears data from all information fields. |

|

|

|

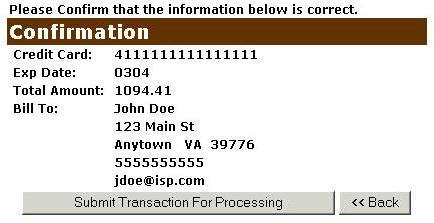

| This screen shows Credit Card information as entered on the previous screen. Verify all information is correct and then press Submit Transaction for Processing button. Press Back button on browser if information is incorrect. |

|

|

|

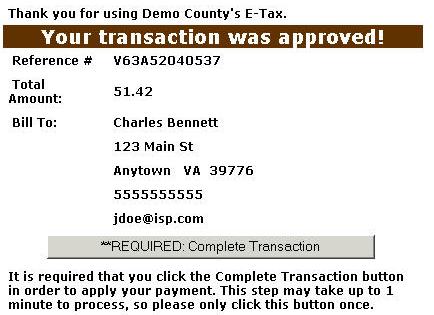

| This screen announces if the transaction was approved. IMPORTANT: You MUST press the **REQUIRED: Complete Transaction button for the transaction to be applied to your property tax bill. |

|

|

|

|

|

| An online receipt is displayed. We recommend you print this receipt for your records. |

|

|

|

| Back to Top |

|

|

| |

| For Credit Card Payments: The convenience fee is 2.95% per transaction. The Convenience Fee is charged by PayPal and our Merchant Account for Accepting Credit Cards Online. The fee is automatically added to your Total Bill. |

| Back to Top |

|